This is another post inspired by my recent

visit to Rio and dialogue at the ABRATES conference, where translators were eager to engage

with MT in a meaningful way, and asked many questions about where the most

interesting translation challenges were. In several conversations about “the

translation market” I had a very clear sense of how there really needs to be a

larger perspective on what this means, as the most interesting opportunities

with MT tend to lie outside what is generally understood as the translation

industry.

For most of the people who attend “translation industry” and localization conferences, the most trusted description of the industry is the market that Common Sense Advisory (CSA) describes as the Language Services Market. A market where translation agencies provide translation, localization and interpreting services to buyers for a fee. This is a market that is estimated by CSA to be $38.16 Billion in 2015, with Lionbridge proudly claiming to be a “perennial list-topper” and the largest language service provider (LSP). Their PR piece provides a clear description of what the CSA market definition covers. This link lists the Top 20 LSPs globally, measured by total revenue. Here is another view of the CSA market summary that shows geographical concentration of the industry.

The following graphic looks more closely at what the focus of the LSP Translation industry is, and we see the kind of content they focus on, and the tools and skills most relevant to addressing translation of this type of content. Thus, project management is the core business function and the most important tools are TMS systems and TM.

While some LSPs do use MT, it is generally not a mission critical tool. MT is used if the LSP is able to pull together an MT system that improves productivity and reduces costs, and is largely reactive i.e. often because the client insisted. But, it is important to understand that the focus is still on the same kind of content shown above. The translation industry has mixed success with MT, and maybe a few systems do become integral to the overall translation production process. But most do-it-yourself LSP MT initiatives fail or wallow in a kind of confused and isolated geekdom with mediocre results. MT systems that consistently produce excellent output are the hardest to develop, so it is somewhat ironic that those that understand the least about how the technology works, try and build the most capable and efficient MT systems. The MT experience that Jost and other translators describe in blogs, described as PEMT, MpT, MT+PE etc.. is presented as the great evil by IAPTI, or horrid commoditization of the work of translation by many others. Most often they are working with MT systems at arms length, and have no ability to steer or guide the MT system development to make it more useful. Hopefully, the notion of Moses-as-instant-magic is now widely understood as a limited success strategy, and the more savvy enterprises and LSPs leave it to experts, who also struggle to meet these consistent high quality output goals. Good MT systems will always take time, expertise and articulate linguistic feedback to develop.

However, I think the new Adaptive Dynamically Learning MT that Lilt is producing has a very bright future with smart LSPs, and provides a platform to transform the MT experience into a much more predictable and worthwhile endeavor and will also allow translators to be much more engaged and involved in steering the MT system.

The graphic above shows the volume of words that Google translates every single day with their MT systems as reported at Google I/O in April 2016. To put this in context, I saw a Lionbridge presentation a few years ago, where the CFO said they translated just over a billion words that year (2009). SDL who is probably the most MT savvy and active with MT LSP, recently claimed they are doing 20B words per month through MT. So, it is quite possible that Google alone, translates more words a week than the whole “translation industry” does in a year. When one considers that perhaps over 90% of Google’s revenue (~$78B/year) is generated from advertising linked to key words, it is quite possible that Google derives tens of billions of dollars from their MT technology initiative! It also gives them very specific intelligence on what matters to people across the world and what cross language content is the most sought after. The economic value of this knowledge is significant, and hidden in the advertising revenue they report. This knowledge of what matters across the globe is something the “translation industry” and SEO experts would love to know.

is another example of high value derived from MT. Their initial

entry into MT was like Google related to search, but additionally they had a

massive knowledge base in English for their software products that was difficult

for their substantial global customer base to efficiently access. Thus, while

Microsoft probably spent hundreds of millions on “translation industry” services

for static content, this only covered a tiny fraction of what they needed to

translate. Given that Microsoft gets as much as 70% of their revenue from

non-English speaking countries, translation of all kinds of product related

content is important. Making more technical support and customer care

content rapidly multilingual was an imperative for executives who cared about

the customer experience, and also generated huge savings in support costs and

dramatically improved the user experience for the non-English speaking

customer. The software industry measures the value of self-service

content by something called deflection cost. So, if they can deflect a call to

the support center, by making more knowledge base content available in more

languages, using MT, they can save possibly as much as a $100M+ per day given

the size of their user base and actual volumes of knowledge base access. Add

maybe another 50B words/day that their Bing MT does for the random internet

user, and we have another stream of economic value coming from search words that

generate advertising revenue across the globe. Their recent Skype STS initiative also will likely yield great benefit and new ways to monetize their translation technology expertise.

is another example of high value derived from MT. Their initial

entry into MT was like Google related to search, but additionally they had a

massive knowledge base in English for their software products that was difficult

for their substantial global customer base to efficiently access. Thus, while

Microsoft probably spent hundreds of millions on “translation industry” services

for static content, this only covered a tiny fraction of what they needed to

translate. Given that Microsoft gets as much as 70% of their revenue from

non-English speaking countries, translation of all kinds of product related

content is important. Making more technical support and customer care

content rapidly multilingual was an imperative for executives who cared about

the customer experience, and also generated huge savings in support costs and

dramatically improved the user experience for the non-English speaking

customer. The software industry measures the value of self-service

content by something called deflection cost. So, if they can deflect a call to

the support center, by making more knowledge base content available in more

languages, using MT, they can save possibly as much as a $100M+ per day given

the size of their user base and actual volumes of knowledge base access. Add

maybe another 50B words/day that their Bing MT does for the random internet

user, and we have another stream of economic value coming from search words that

generate advertising revenue across the globe. Their recent Skype STS initiative also will likely yield great benefit and new ways to monetize their translation technology expertise.

When you consider that both Intel and Adobe also use the Microsoft Hub MT to translate knowledge base support content, the deflected cost savings impact is easily worth hundreds of millions of dollars a day. This is not even considering the many other IT companies doing this on their own using other MT technology e.g. Symantec. The “translation industry” has a very small footprint in this kind of translation activity,which is now often considered mission-critical and probably involves several billion words per month.

The online eCommerce market is another example of economic value generated by competent MT efforts that is off-the-books of the

“translation industry”. EBay

decided some years ago that emerging economies were a huge opportunity worth

strategic attention. So they

acquired MT technology and built a

competent MT team that had astrong linguistic collaborative component in the

team. Based on presentations they made at the AMTA 2014 conference it was

clear that there was a huge growth impact in the Russian market

from their initial efforts to to make more Russian content available. It would

be safe to say that the value of the impact is probably in the hundreds of

millions of dollars of new revenue, from all the new markets that they have been

addressing using MT. It is also really worth taking a look at what is involved

in doing this. It takes focus on solving new

kinds of translation problems and making sure

the translation problems you solve do enhance the value of your MT efforts.

This last link shows the special issues related just to Brazilian

Portuguese. We should note that most competent MT efforts of any scale, move

carefully, one language at time rather than trying to do 20 or 30 in a single go.

We also see that Amazon acquired Safaba in 2015 and possibly have similar plans

to make catalogue content multilingual to drive bigger volumes of international

business. Alibaba and Baidu also have eCommerce focused MT efforts well underway

but fewer details are available. The net economic value of all these type of MT

initiatives: Probably in excess of $20B per year by my very rough estimates.

The online eCommerce market is another example of economic value generated by competent MT efforts that is off-the-books of the

“translation industry”. EBay

decided some years ago that emerging economies were a huge opportunity worth

strategic attention. So they

acquired MT technology and built a

competent MT team that had astrong linguistic collaborative component in the

team. Based on presentations they made at the AMTA 2014 conference it was

clear that there was a huge growth impact in the Russian market

from their initial efforts to to make more Russian content available. It would

be safe to say that the value of the impact is probably in the hundreds of

millions of dollars of new revenue, from all the new markets that they have been

addressing using MT. It is also really worth taking a look at what is involved

in doing this. It takes focus on solving new

kinds of translation problems and making sure

the translation problems you solve do enhance the value of your MT efforts.

This last link shows the special issues related just to Brazilian

Portuguese. We should note that most competent MT efforts of any scale, move

carefully, one language at time rather than trying to do 20 or 30 in a single go.

We also see that Amazon acquired Safaba in 2015 and possibly have similar plans

to make catalogue content multilingual to drive bigger volumes of international

business. Alibaba and Baidu also have eCommerce focused MT efforts well underway

but fewer details are available. The net economic value of all these type of MT

initiatives: Probably in excess of $20B per year by my very rough estimates.

Recently Facebook surprised the world by announcing that

they have a

substantial MT effort underway after using the Microsoft Bing MT technology

for several years. When asked why they did this Alan Packer said: Scale is one

reason Facebook has invested in its own MT technology. The other reason is

adaptability, they wanted technology that was optimized for their very specific

needs. Facebook is now serving 2 billion text translations per day. The problem

they had with Bing they claimed was, it was built to translate properly written

website text and did not do well with the slang, metaphor and idiom typical in

Facebook comments. Packer described Facebook language as “extremely informal.

It’s full of slang, it’s very regional.” He said it is also laden with

metaphors, idiomatic expressions, and is riddled with misspellings (most of them

intentional). Additionally, as in the rest of the world, there is a marked

difference in the way different age groups communicate on Facebook. They know

that already 50% of Facebook users regularly use auto translation. This user

group will only grow as more people come online. Packer says that access to the

translation product leads users to “have more friends, more friends of friends,

and get exposed to more concepts and cultures.” The more people across

the world that Facebook users can connect with, the longer they’ll spend on the

social network, and the more revenue-earning ads they’ll see. The

economic value of this is probably several

billion dollars a year. Emerging social networks that are global will need

to address the same problem.

Recently Facebook surprised the world by announcing that

they have a

substantial MT effort underway after using the Microsoft Bing MT technology

for several years. When asked why they did this Alan Packer said: Scale is one

reason Facebook has invested in its own MT technology. The other reason is

adaptability, they wanted technology that was optimized for their very specific

needs. Facebook is now serving 2 billion text translations per day. The problem

they had with Bing they claimed was, it was built to translate properly written

website text and did not do well with the slang, metaphor and idiom typical in

Facebook comments. Packer described Facebook language as “extremely informal.

It’s full of slang, it’s very regional.” He said it is also laden with

metaphors, idiomatic expressions, and is riddled with misspellings (most of them

intentional). Additionally, as in the rest of the world, there is a marked

difference in the way different age groups communicate on Facebook. They know

that already 50% of Facebook users regularly use auto translation. This user

group will only grow as more people come online. Packer says that access to the

translation product leads users to “have more friends, more friends of friends,

and get exposed to more concepts and cultures.” The more people across

the world that Facebook users can connect with, the longer they’ll spend on the

social network, and the more revenue-earning ads they’ll see. The

economic value of this is probably several

billion dollars a year. Emerging social networks that are global will need

to address the same problem.

So what we see is that a select few companies are generating more economic value from solving very specialized and much more challenging translation problems than the whole gross revenue output of the “translation industry”. Solving large-scale translation problems using MT is apparently a very high value proposition, and none of the global enterprises mentioned above considered going to the “translation industry” to help solve these really challenging and complex translation problems. Probably because it is very clear to any strategic observer at these companies, that most LSPs lack the vision, skill, interest and competence to solve these types of translation problems. We can perhaps even generalize the core requirements for a larger set of global enterprises as shown below. There is a real mismatch in terms of skills and focus between the broader translation needs of global enterprises and the service focus of the “translation industry”. While the static content will likely remain important as a mandated requirement, it is not where long-term corporate value is built either for the enterprise buyer or the LSP in my opinion.

To illustrate this further let us consider the investor sentiment on value that can be gleaned from stock market data. While this might be a stretch of logic to some, I think we can fairly assume that investors value solutions to certain kinds of translation problems more than others. Facebook has seen a huge growth in mobile ad revenues and it seems that they are taking ad share away from Google recently, and so these Market Value/Sales numbers reflect very active market trends. The investor sentiment is that Facebook is probably better poised to gain $$$s from the next wave of internet adoption than any of the companies listed in the chart as they climb beyond 2B users, very few who speak English or French or German. As one analyst says: "Advertising budgets are moving towards Facebook, and it seems to be a winner in the online advertising world with measurable results." Contrast this with the investor sentiment for large LSPs, surely, it has something to do with long-term promise and potential. To me this suggests that investors in general view the LSP focus as lower in value but understand that translation can produce huge leverage in the right hands.

So to those wonderful translators at ABRATES who asked me what kinds of MT projects to get involved with, I would say the following:

For most of the people who attend “translation industry” and localization conferences, the most trusted description of the industry is the market that Common Sense Advisory (CSA) describes as the Language Services Market. A market where translation agencies provide translation, localization and interpreting services to buyers for a fee. This is a market that is estimated by CSA to be $38.16 Billion in 2015, with Lionbridge proudly claiming to be a “perennial list-topper” and the largest language service provider (LSP). Their PR piece provides a clear description of what the CSA market definition covers. This link lists the Top 20 LSPs globally, measured by total revenue. Here is another view of the CSA market summary that shows geographical concentration of the industry.

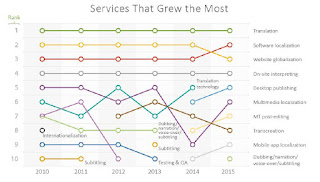

*The Language Services Market 2015, Common Sense Advisory Research, June 2015

This CSA sourced graphic from the Lionbridge blog describes the fastest growth segments in the language services market. Clearly, translation, software and website globalization are at the top of the growth list for this type of paid translation service.

The following graphic looks more closely at what the focus of the LSP Translation industry is, and we see the kind of content they focus on, and the tools and skills most relevant to addressing translation of this type of content. Thus, project management is the core business function and the most important tools are TMS systems and TM.

While some LSPs do use MT, it is generally not a mission critical tool. MT is used if the LSP is able to pull together an MT system that improves productivity and reduces costs, and is largely reactive i.e. often because the client insisted. But, it is important to understand that the focus is still on the same kind of content shown above. The translation industry has mixed success with MT, and maybe a few systems do become integral to the overall translation production process. But most do-it-yourself LSP MT initiatives fail or wallow in a kind of confused and isolated geekdom with mediocre results. MT systems that consistently produce excellent output are the hardest to develop, so it is somewhat ironic that those that understand the least about how the technology works, try and build the most capable and efficient MT systems. The MT experience that Jost and other translators describe in blogs, described as PEMT, MpT, MT+PE etc.. is presented as the great evil by IAPTI, or horrid commoditization of the work of translation by many others. Most often they are working with MT systems at arms length, and have no ability to steer or guide the MT system development to make it more useful. Hopefully, the notion of Moses-as-instant-magic is now widely understood as a limited success strategy, and the more savvy enterprises and LSPs leave it to experts, who also struggle to meet these consistent high quality output goals. Good MT systems will always take time, expertise and articulate linguistic feedback to develop.

However, I think the new Adaptive Dynamically Learning MT that Lilt is producing has a very bright future with smart LSPs, and provides a platform to transform the MT experience into a much more predictable and worthwhile endeavor and will also allow translators to be much more engaged and involved in steering the MT system.

The Larger Context for Value Added Translation

Though the “translation industry” MT experience is mixed, I would argue that MT has been responsible for driving revenue or definable economic value in a variety of non-traditional scenarios, on a scale that dwarfs “the translation industry” as defined above. Interestingly, the most successful implementations of MT are done by global enterprises who often still work with LSPs for the static structured content, but for the higher value unstructured dynamic content are largely choosing to do it themselves (sometimes with some expert help) or build internal teams to address what they see as a long-term and strategic need to enhance international business initiatives. It is useful to consider some case studies of these strategic MT initiatives by enterprises, to understand this better.

The graphic above shows the volume of words that Google translates every single day with their MT systems as reported at Google I/O in April 2016. To put this in context, I saw a Lionbridge presentation a few years ago, where the CFO said they translated just over a billion words that year (2009). SDL who is probably the most MT savvy and active with MT LSP, recently claimed they are doing 20B words per month through MT. So, it is quite possible that Google alone, translates more words a week than the whole “translation industry” does in a year. When one considers that perhaps over 90% of Google’s revenue (~$78B/year) is generated from advertising linked to key words, it is quite possible that Google derives tens of billions of dollars from their MT technology initiative! It also gives them very specific intelligence on what matters to people across the world and what cross language content is the most sought after. The economic value of this knowledge is significant, and hidden in the advertising revenue they report. This knowledge of what matters across the globe is something the “translation industry” and SEO experts would love to know.

is another example of high value derived from MT. Their initial

entry into MT was like Google related to search, but additionally they had a

massive knowledge base in English for their software products that was difficult

for their substantial global customer base to efficiently access. Thus, while

Microsoft probably spent hundreds of millions on “translation industry” services

for static content, this only covered a tiny fraction of what they needed to

translate. Given that Microsoft gets as much as 70% of their revenue from

non-English speaking countries, translation of all kinds of product related

content is important. Making more technical support and customer care

content rapidly multilingual was an imperative for executives who cared about

the customer experience, and also generated huge savings in support costs and

dramatically improved the user experience for the non-English speaking

customer. The software industry measures the value of self-service

content by something called deflection cost. So, if they can deflect a call to

the support center, by making more knowledge base content available in more

languages, using MT, they can save possibly as much as a $100M+ per day given

the size of their user base and actual volumes of knowledge base access. Add

maybe another 50B words/day that their Bing MT does for the random internet

user, and we have another stream of economic value coming from search words that

generate advertising revenue across the globe. Their recent Skype STS initiative also will likely yield great benefit and new ways to monetize their translation technology expertise.

is another example of high value derived from MT. Their initial

entry into MT was like Google related to search, but additionally they had a

massive knowledge base in English for their software products that was difficult

for their substantial global customer base to efficiently access. Thus, while

Microsoft probably spent hundreds of millions on “translation industry” services

for static content, this only covered a tiny fraction of what they needed to

translate. Given that Microsoft gets as much as 70% of their revenue from

non-English speaking countries, translation of all kinds of product related

content is important. Making more technical support and customer care

content rapidly multilingual was an imperative for executives who cared about

the customer experience, and also generated huge savings in support costs and

dramatically improved the user experience for the non-English speaking

customer. The software industry measures the value of self-service

content by something called deflection cost. So, if they can deflect a call to

the support center, by making more knowledge base content available in more

languages, using MT, they can save possibly as much as a $100M+ per day given

the size of their user base and actual volumes of knowledge base access. Add

maybe another 50B words/day that their Bing MT does for the random internet

user, and we have another stream of economic value coming from search words that

generate advertising revenue across the globe. Their recent Skype STS initiative also will likely yield great benefit and new ways to monetize their translation technology expertise.When you consider that both Intel and Adobe also use the Microsoft Hub MT to translate knowledge base support content, the deflected cost savings impact is easily worth hundreds of millions of dollars a day. This is not even considering the many other IT companies doing this on their own using other MT technology e.g. Symantec. The “translation industry” has a very small footprint in this kind of translation activity,which is now often considered mission-critical and probably involves several billion words per month.

The online eCommerce market is another example of economic value generated by competent MT efforts that is off-the-books of the

“translation industry”. EBay

decided some years ago that emerging economies were a huge opportunity worth

strategic attention. So they

acquired MT technology and built a

competent MT team that had astrong linguistic collaborative component in the

team. Based on presentations they made at the AMTA 2014 conference it was

clear that there was a huge growth impact in the Russian market

from their initial efforts to to make more Russian content available. It would

be safe to say that the value of the impact is probably in the hundreds of

millions of dollars of new revenue, from all the new markets that they have been

addressing using MT. It is also really worth taking a look at what is involved

in doing this. It takes focus on solving new

kinds of translation problems and making sure

the translation problems you solve do enhance the value of your MT efforts.

This last link shows the special issues related just to Brazilian

Portuguese. We should note that most competent MT efforts of any scale, move

carefully, one language at time rather than trying to do 20 or 30 in a single go.

We also see that Amazon acquired Safaba in 2015 and possibly have similar plans

to make catalogue content multilingual to drive bigger volumes of international

business. Alibaba and Baidu also have eCommerce focused MT efforts well underway

but fewer details are available. The net economic value of all these type of MT

initiatives: Probably in excess of $20B per year by my very rough estimates.

The online eCommerce market is another example of economic value generated by competent MT efforts that is off-the-books of the

“translation industry”. EBay

decided some years ago that emerging economies were a huge opportunity worth

strategic attention. So they

acquired MT technology and built a

competent MT team that had astrong linguistic collaborative component in the

team. Based on presentations they made at the AMTA 2014 conference it was

clear that there was a huge growth impact in the Russian market

from their initial efforts to to make more Russian content available. It would

be safe to say that the value of the impact is probably in the hundreds of

millions of dollars of new revenue, from all the new markets that they have been

addressing using MT. It is also really worth taking a look at what is involved

in doing this. It takes focus on solving new

kinds of translation problems and making sure

the translation problems you solve do enhance the value of your MT efforts.

This last link shows the special issues related just to Brazilian

Portuguese. We should note that most competent MT efforts of any scale, move

carefully, one language at time rather than trying to do 20 or 30 in a single go.

We also see that Amazon acquired Safaba in 2015 and possibly have similar plans

to make catalogue content multilingual to drive bigger volumes of international

business. Alibaba and Baidu also have eCommerce focused MT efforts well underway

but fewer details are available. The net economic value of all these type of MT

initiatives: Probably in excess of $20B per year by my very rough estimates. Recently Facebook surprised the world by announcing that

they have a

substantial MT effort underway after using the Microsoft Bing MT technology

for several years. When asked why they did this Alan Packer said: Scale is one

reason Facebook has invested in its own MT technology. The other reason is

adaptability, they wanted technology that was optimized for their very specific

needs. Facebook is now serving 2 billion text translations per day. The problem

they had with Bing they claimed was, it was built to translate properly written

website text and did not do well with the slang, metaphor and idiom typical in

Facebook comments. Packer described Facebook language as “extremely informal.

It’s full of slang, it’s very regional.” He said it is also laden with

metaphors, idiomatic expressions, and is riddled with misspellings (most of them

intentional). Additionally, as in the rest of the world, there is a marked

difference in the way different age groups communicate on Facebook. They know

that already 50% of Facebook users regularly use auto translation. This user

group will only grow as more people come online. Packer says that access to the

translation product leads users to “have more friends, more friends of friends,

and get exposed to more concepts and cultures.” The more people across

the world that Facebook users can connect with, the longer they’ll spend on the

social network, and the more revenue-earning ads they’ll see. The

economic value of this is probably several

billion dollars a year. Emerging social networks that are global will need

to address the same problem.

Recently Facebook surprised the world by announcing that

they have a

substantial MT effort underway after using the Microsoft Bing MT technology

for several years. When asked why they did this Alan Packer said: Scale is one

reason Facebook has invested in its own MT technology. The other reason is

adaptability, they wanted technology that was optimized for their very specific

needs. Facebook is now serving 2 billion text translations per day. The problem

they had with Bing they claimed was, it was built to translate properly written

website text and did not do well with the slang, metaphor and idiom typical in

Facebook comments. Packer described Facebook language as “extremely informal.

It’s full of slang, it’s very regional.” He said it is also laden with

metaphors, idiomatic expressions, and is riddled with misspellings (most of them

intentional). Additionally, as in the rest of the world, there is a marked

difference in the way different age groups communicate on Facebook. They know

that already 50% of Facebook users regularly use auto translation. This user

group will only grow as more people come online. Packer says that access to the

translation product leads users to “have more friends, more friends of friends,

and get exposed to more concepts and cultures.” The more people across

the world that Facebook users can connect with, the longer they’ll spend on the

social network, and the more revenue-earning ads they’ll see. The

economic value of this is probably several

billion dollars a year. Emerging social networks that are global will need

to address the same problem. So what we see is that a select few companies are generating more economic value from solving very specialized and much more challenging translation problems than the whole gross revenue output of the “translation industry”. Solving large-scale translation problems using MT is apparently a very high value proposition, and none of the global enterprises mentioned above considered going to the “translation industry” to help solve these really challenging and complex translation problems. Probably because it is very clear to any strategic observer at these companies, that most LSPs lack the vision, skill, interest and competence to solve these types of translation problems. We can perhaps even generalize the core requirements for a larger set of global enterprises as shown below. There is a real mismatch in terms of skills and focus between the broader translation needs of global enterprises and the service focus of the “translation industry”. While the static content will likely remain important as a mandated requirement, it is not where long-term corporate value is built either for the enterprise buyer or the LSP in my opinion.

To illustrate this further let us consider the investor sentiment on value that can be gleaned from stock market data. While this might be a stretch of logic to some, I think we can fairly assume that investors value solutions to certain kinds of translation problems more than others. Facebook has seen a huge growth in mobile ad revenues and it seems that they are taking ad share away from Google recently, and so these Market Value/Sales numbers reflect very active market trends. The investor sentiment is that Facebook is probably better poised to gain $$$s from the next wave of internet adoption than any of the companies listed in the chart as they climb beyond 2B users, very few who speak English or French or German. As one analyst says: "Advertising budgets are moving towards Facebook, and it seems to be a winner in the online advertising world with measurable results." Contrast this with the investor sentiment for large LSPs, surely, it has something to do with long-term promise and potential. To me this suggests that investors in general view the LSP focus as lower in value but understand that translation can produce huge leverage in the right hands.

So to those wonderful translators at ABRATES who asked me what kinds of MT projects to get involved with, I would say the following:

- Focus on companies who are solving interesting translation problems. They will have the most rewarding work and it might involve stepping out of the translation industry.

- Stay away from LSPs who sell the Moses Mirage, this is likely to be the worst PEMT experience. MT systems that don't want translator feedback at a pattern level are not likely to be a professionally satisfying experience.

- Work with people (LSP/Enterprise) who allow and want you (translator/editor) to provide feedback and interact with the MT development process.

- Learn about Machine Learning and AI in other domains, and develop skills with Regex, Corpus Analysis & Corpus Editing and Pattern Identification skills to be considered valuable.

- Explore Adaptive Dynamic Learning MT like Lilt (maybe others will appear soon) to understand how MT can work with you and for you while you wait for the right opportunity. This is truly a paradigm shift that is worth at least some experimentation to see how the translator desktop could evolve.

- Ease up on the need to have everything on the desktop. The future of Machine Intelligence solutions will require big data and big computing, so the best and most sophisticated tools will by definition only be available in the cloud. Lilt is a first generation example of this, others are coming. The cloud makes sense and allows new, more effective ways to solve old problems and is not a bad thing.

Great and useful post - thank you guy! This is just what I needed.

ReplyDeleteLuigi

ReplyDeleteI will be writing very regularly for the next few months and have some subjects in mind.

If you would like to cross post your big data post here as well I would be happy to do so.

Happy Summer.

Kirti

Wonderful article! Thank you so much!

ReplyDeleteIn case you missed it the traditional market has grown and I am sure LIOX will publicize their ranking again. But this again just emphasizes that the high value translation market is OUTSIDE the traditional market.

ReplyDeleteGlobal market for "language services and technology" will be GT US$40 billion in 2016 tinyurl.com/za9usd7 via @CSA_Research #t10n

This is an update to Facebook's earnings and it clearly illustrates why they have the most leveraged valuation -- their earnings are driven by Mobile and Video and they are having difficulty finding ad space to sell http://www.wsj.com/articles/5-things-marketers-should-note-from-facebooks-second-quarter-earnings-1469660053

ReplyDeleteThey know that already 50% of Facebook users regularly use auto translation. - There is no way this figure is correct.

ReplyDelete(to elaborate on my earlier comment): apparently according to Facebook, over 50% of users SEE auto-translated content. That does not mean they UNDERSTAND or APPROVE OF or even CHOOSE auto-translated content. And we also know that this 'content' is largely ads.

ReplyDeleteAwesome article.

ReplyDelete